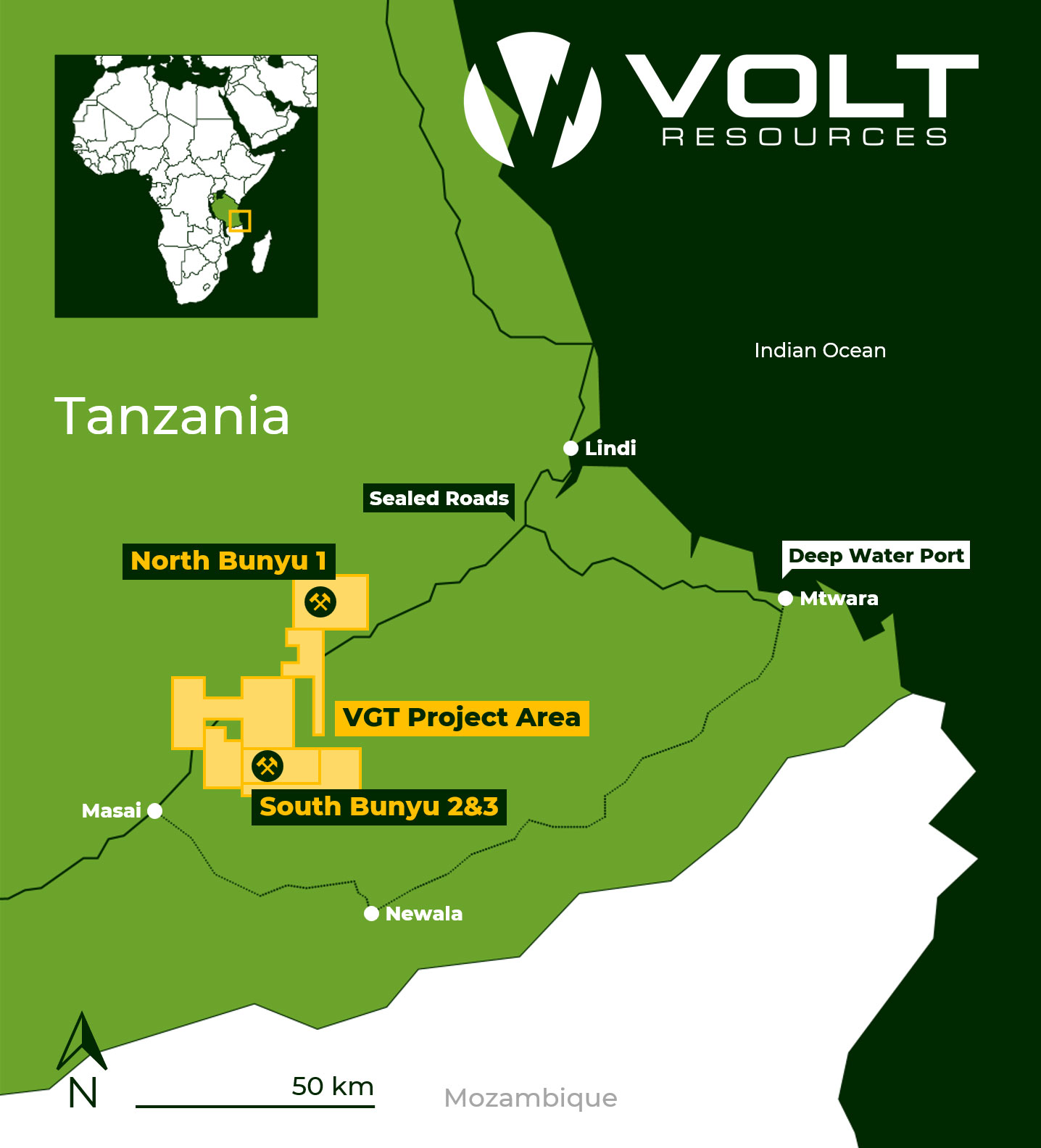

The Bunyu Graphite Project is wholly owned by Volt Resources and is located in Tanzania, East Africa. The project is ideally located near to critical infrastructure with sealed roads running through the project area and ready access to the deep-water port of Mtwara 140km from the Project.

Project Highlights

- One of the largest graphite deposits in the world. Bunyu is the largest JORC Mineral resource in Tanzania

- Resource 461 million tonnes @ 4.9% TGC for 22.6 million tonnes contained graphite

- Huge upside potential with exploration to date covering less than 6% of the project area

- Two stage development strategy with Stage 1 significantly de-risking an expansion

- Stage 1 to produce 24,780 tpa flake graphite (@ 6.26% TGC feed grade) and Stage 2 expansion increases annual production to circa 170,000 tpa flake graphite

- Environmental Impact Assessment Certificate and Mining Licences received covering both Stage 1 and 2

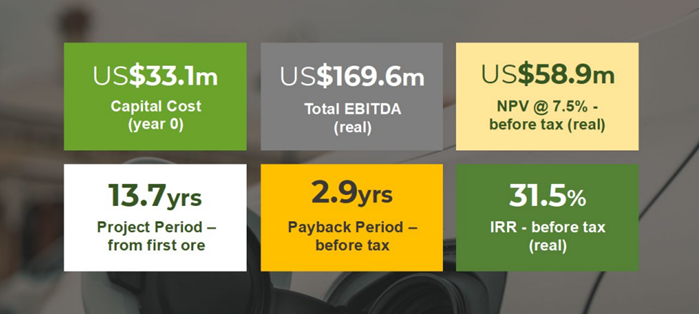

Stage 1 Stage 1 NPV Economics

Stage 1 Bunyu Graphite all sold under Offtakes

Graphex Group Limited

Binding offtake agreement signed with global battery anode material producer Graphex Group Limited subsidiary, Graphex Michigan LLC.

- 10,000 tpa fine flake graphite for five years

- An option to extend a further five years

- Stage 1 fine graphite product is sold for first 10 years

Qingdao Baixing Graphite Company Ltd

Binding offtake agreement signed with established producer of graphite products.

- 12,000-90,000 tpa coarse flake graphite for five years

- An option to extend a further five years

- Stage 1 coarse graphite product is sold for first 10 years

Natural Flake Graphite Product Specifications

Stage 1 Bunyu natural graphite typical product specification

- Flexibility to produce higher TGC grade products if required

- Bunyu natural graphite product suitable for a range of end use applications including battery anode material, refractories, foils, gaskets, dry lubricants, graphene and other applications

- Planned two stage development and large-scale resource provides for multi-decade supply of graphite products

Concentrate Typical Quality

| Size (micron) | Size (#) | % Distribution |

| +300 | +50 | 12 |

| +180 | +80 | 27 |

| +150 | +100 | 15 |

| -150 | -100 | 46 |

Impurities (Indicative)

| Analyte | Unit | Indicative |

| Fe | % | 0.28 |

| Ca | % | 0.25 |

| S | % | 0.02 |

| Si02 | % | 3.1 |

| Al | % | 0.64 |

| Cu | ppm | 15 |

| Zn | ppm | 15 |

| V | ppm | 50 |